- Selling

- Buying

- Landlords

- B&R Landlord hub

- Management services

- Vacant management

- Landlord reviews

- Rental investment

- Furnishing and refurbishment

- Renters’ Rights Act

- Yield calculator

- Free online valuation

- Stamp duty calculator

- ROI calculator

- Landlord resources

- EPC guide

- Video hub

- Area guides

- Fees for landlord

- Lettings Laws

- Why choose Benham and Reeves

- Renting

- New homes

- House prices

- International services

International offices

China, Hong Kong SAR, India, Indonesia, Malaysia, Middle East, Pakistan, Qatar, Singapore, Thailand and Turkey

Learn more - Contact

- News

- Contact

- About us

- My B&R

Home News

Property market updates

It now takes longer than ever to complete on a London home purchase

It now takes longer than ever to complete on a London home purchase

|

Getting your Trinity Audio player ready... |

Contents

The average time it takes to buy or sell a house in the UK, from acceptance of a buyer’s offer to legal completion of the deal, has increased by 26% in the last five years.

According to recent figures published by Rightmove, it now takes an Average of 149 days to sell a property up from the 119 days it took back in 2019. If you also add the time it takes to find a buyer in the first instance, it now takes 209 days, up from 182 days in 2019 (up 15%).

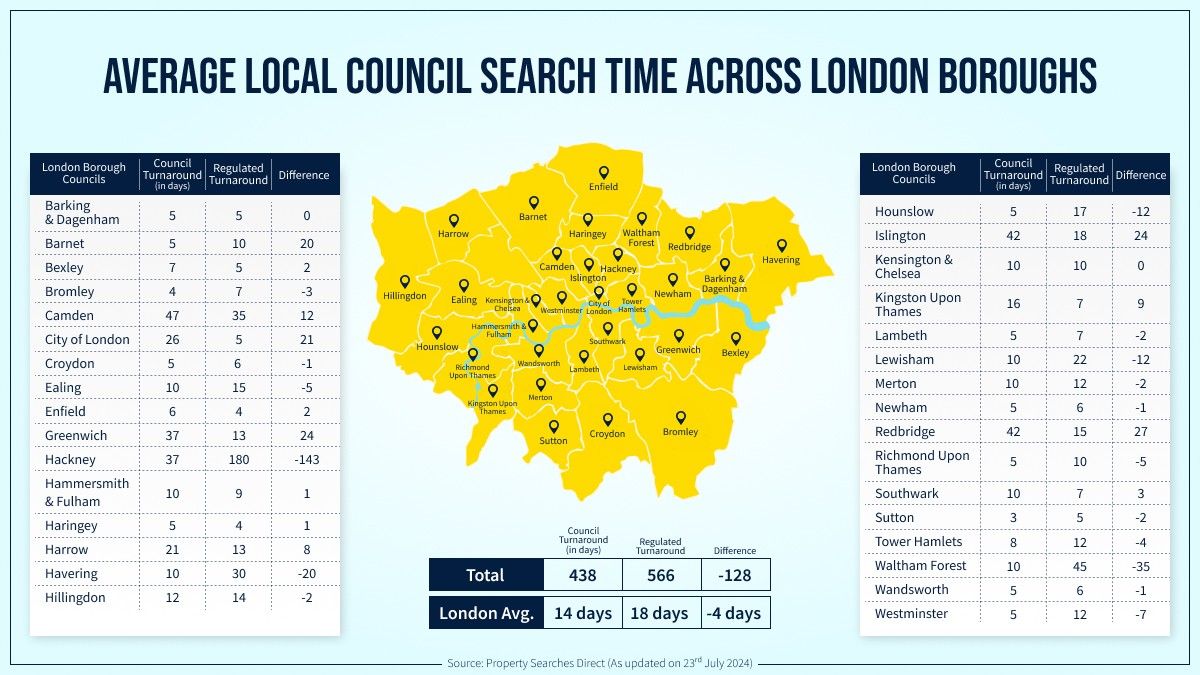

Source: Property Searches Direct (As updated on 23rd July 2024)

So what is causing this ever-frustrating delay in property deals? Is it an increase in bureaucracy? Are law firms and agents understaffed? Are they just too cheap with remote conveyancing services costing the buyer? or is it a combination of all of these factors and more?

In this blog we delve deeper into why it takes so long to buy or sell a property in London.

Disproportionate time for local council searches

Local authority search applications, which reveal important information about a property and its surrounding areas such as pending charges/penalties and upcoming plans, roads, railways, etc, are essential to the overall conveyancing process. Although the London average return rate for local searches is a modest 14 days, these vary drastically borough to borough. According to data published by Property Searches Direct, in Sutton local searches take an average of three days, while the same process takes 47 days in Camden and 43 days in Islington and in Redbridge.

To reduce their dependence on councils several buyers pay for searches privately and some sellers even go the extra mile to complete these searches before putting their properties on the market. City of London, Greenwich and Redbridge are examples of where such proactiveness has paid off, speeding the process by nearly three weeks.

Fewer conveyancers and solicitors than before

While the unprecedented pandemic property boom further stretched the already stressed staff of conveyancing and law firms in the country, the overall reduction in such firms only increased the pile of case files. According to IRN Legal’s conveyancing market report for 2023, the number of law firms engaged in conveyancing in the UK dropped by 455 over the between 2021 and 2023. Similarly, according to various other law society reports, the conveyancing profession has lost around 13% of its workforce from around 13,000 practioners to 11,250 in that time.

While pandemic-induced challenges are credible reasons for the industry to shrink in size, many experts also attribute the general perception around conveyancing, which is viewed poorly in comparison to other law disciplines, hampering the recruitment of more individuals. Furthermore, conveyance training is a resource-intensive activity, taking months and affecting the ongoing attempts to improve the conveyancing capacity of existing firms that have taken on more instructions than they can manage.

High-rise towers and the ambiguous Building Safety Act

New legislation can send law firms into disarray and that’s exactly why many solicitors now refuse to take up cases involving leasehold properties in a building over five storeys or 11 meters. The Building Safety Act passed in 2022 mandates all building owners and developers to endure the cost of safety fixes in blocks of flats without increasing the service charge levied on leaseholders. This means extra work for many understaffed law firms, as they now have to satisfy building eligibility, qualifying leases and work around growing lender requirements. While there is no official data available on the number of conveyancers refusing to take up apartment blocks covered by the Act, an approximation shared by experts reveals one in every five conveyancers is refusing such jobs. If extrapolated at a national level, the figure climbs up to over 1,250 conveyancing companies.

The rise of cheaper options

According to Compare My Move’s Cost of Moving House Index 2024, the average cost of conveyancing when buying a house in 2024 is £1,567. This is 18.7% more than it cost last year. However, cheaper companies, with fewer qualified conveyancers and more call centre staff, are taking over the industry with competitive pricing, providing services for as low as £300 (or less than one-fifth of the national average). While this may seem attractive to some buyers and sellers looking to cut solicitor costs, it can be counterproductive as it is usually the opposite party in the deal and their solicitors who have to work with inept customer service executives instead of conveyancing professionals. Many deals fall through when genuine buyers or sellers are left to deal with inexperienced, untrained, unprofessional and sometimes unavailable individuals.

This is not to say that cheap services don’t work at all. However, it should be considered solely based on the complexity of a transaction. If the property, whether a house or flat, is part of a large estate with many other units sold previously in the same way and the conveyancer only needs to follow what has been done earlier, such a cost-effective and no-frills arrangement can work. But for unconventional or standalone properties without any direct precedent, the entire conveyancing process needs to start from scratch. For such properties, you will need the help of an expert who can guarantee promptness and high-quality service delivered with in-person communication and personalised support, which comes at a premium and can cost up to £5,000 or even more.

Lack of coordination and working in silos

As the saying goes, “Teamwork makes the dream work”, and the dream of buying or selling a house in London needs all the players to be in sync and communicate with each other. These players include a reputable estate agent, a committed solicitor and an efficient mortgage broker (if applicable), with you as the hands-on monitor overseeing the entire process. Many buyers and sellers fail to get all three right, resulting in frequent delays which can be avoided right at the start.

As the estate agents’ is the first door you will knock on, many agents, including us at Benham & Reeves, have a pool of reputable solicitors and conveyancers we have worked with over the years and can vouch for to deliver excellence. Depending on the intricacies of your case, we can recommend a professional to take on the arduous job of conveyancing. Similarly, we also have connections with leading mortgage brokers and the banks or lenders they work with to facilitate a smooth, seamless and highly professional buying and selling journey for our clients.

Over 35% of all property sales fall through

According to data published by Quick Move Now, over 35% of all property deals in the UK last year fell through, with almost half of these unsuccessful outcomes being caused by buyer indecision over the renegotiation of sale price or withdrawal after the survey stage. Chain-break, slow progress and issues with securing mortgages are among the other reasons cited for deals not going through.

| Reasons why property sales fall through | Failed sales in % |

|---|---|

| Buyer changes mind or tries to renegotiate price or withdraws after property survey | 49% |

| Chain-break | 19% |

| Slow progress | 17% |

| Difficulty with securing mortgage | 10% |

| Other circumstantial changes | 3% |

| Legal issues | 2% |

Source: Quick Move Now

Is there any change on the horizon?

Property experts believe that the biggest challenge impeding the pace of successful property transactions is the cumbersome nature of the existing conveyancing process, which still, to a large extent depends on more paperwork and less digitisation. By taking the process online and establishing seamless communication between agents, solicitors, mortgage brokers and lenders, the entire process is being transformed into one mega-entity instead of several fragmented services operating in their respective silos.

This will help eliminate operational inefficiencies, such as the need for buyers and sellers to provide the same documentation separately to each service provider. A centralised platform or portal connecting everyone working on a deal together is the projected way forward for most property professionals to optimise the conveyancing process and eventual timelines for the purchase and sale of properties.

Many leading mortgage lenders and property experts have already begun spinning the wheel for the digital revolution in prop-tech by investing together. An example of this is the announcement made earlier this year, where the country’s leading mortgage lenders, including NatWest, Nationwide and Lloyds Banking Group, joined with Rightmove to invest £10 million in the property data network Coadjute. With many leading estate agencies already subscribing to such platforms, the UK’s property industry is gearing up for more tech-enabled optimism and lesser frustration caused by slow-moving paperwork.

Fingers crossed.

Sign up to our newsletter

Subscribe

How much is your property worth?