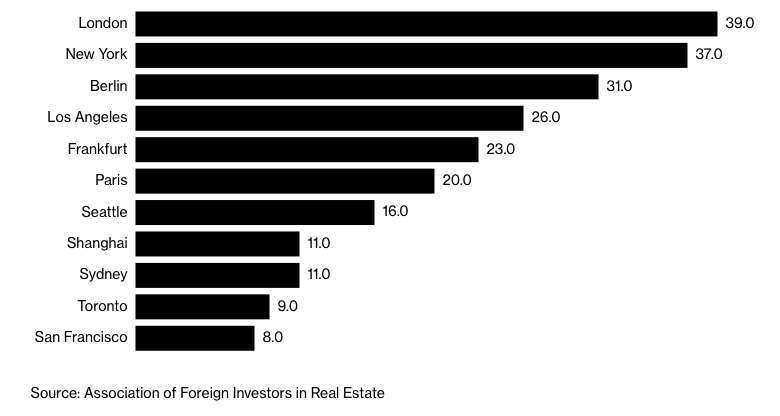

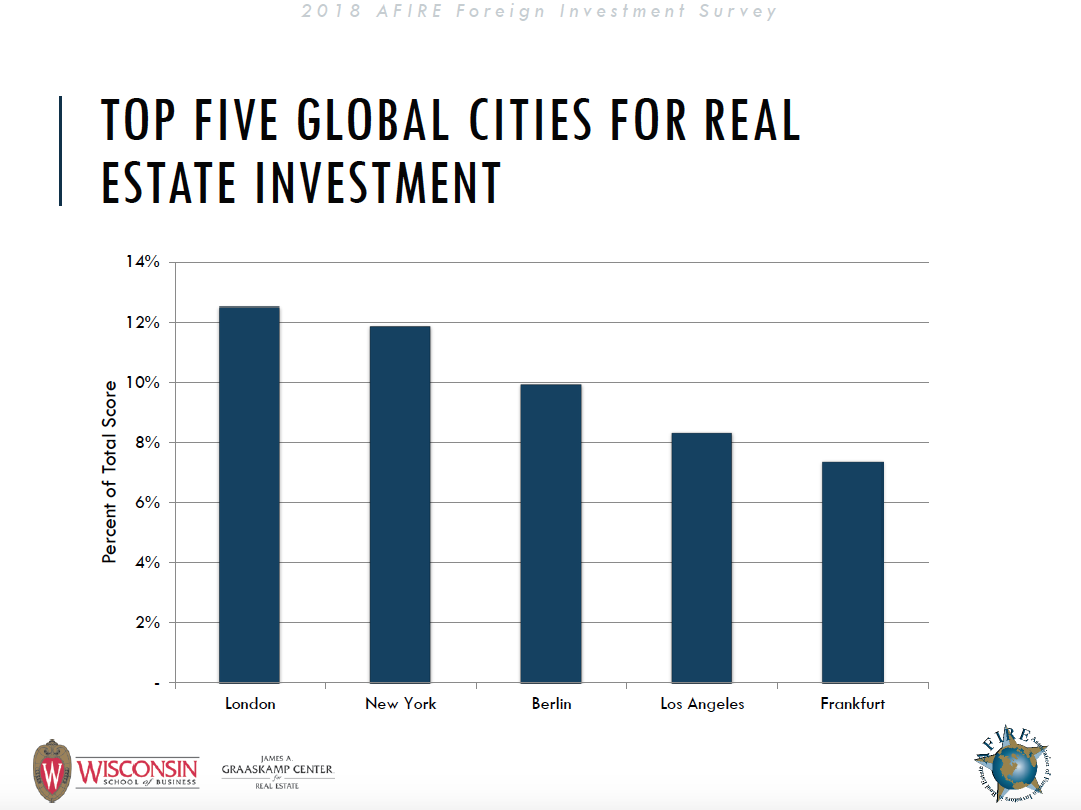

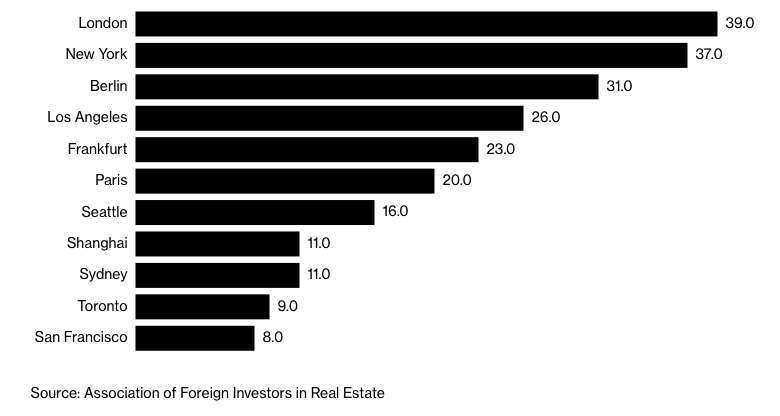

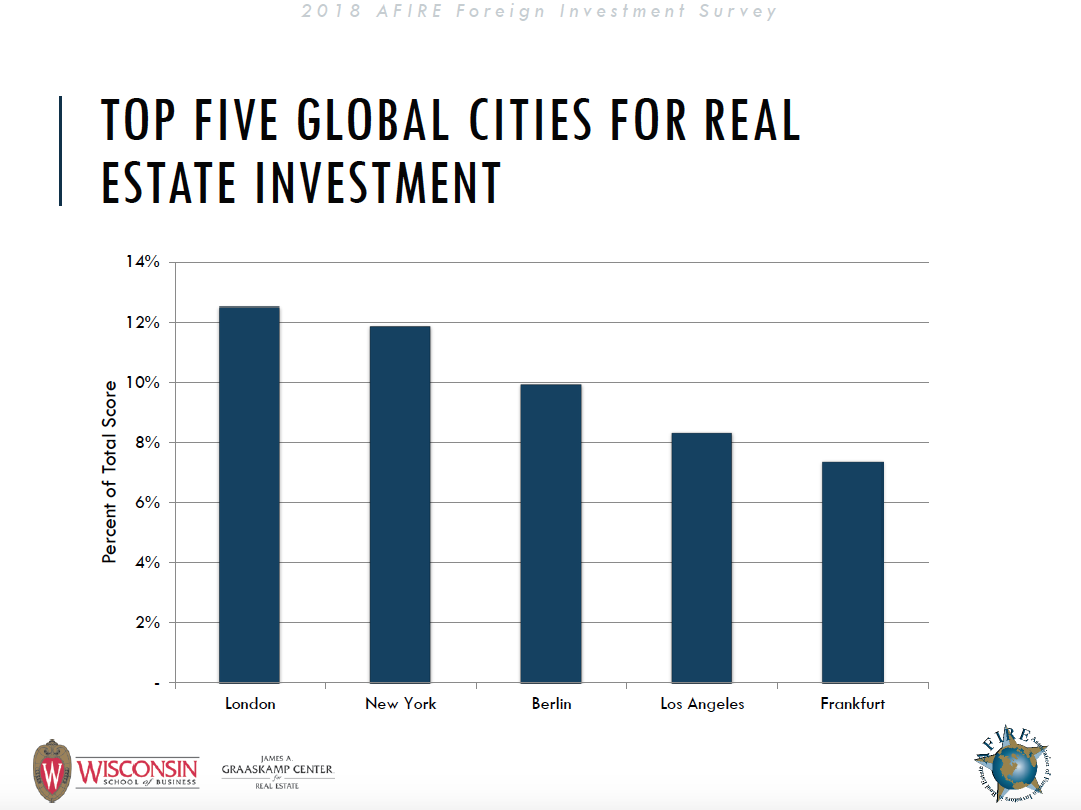

In a recent survey by the Association of Foreign Investors in Real Estate, its members have voted London as the top global location for foreign property investment, up from third place last year.

The members of the Association of Foreign Investors in Real Estate make up the largest international institutional real estate investors in the world, counting for an estimated $2 trillion worth of global property investment.

Despite fears around the impact of Brexit in 2017, confidence in London’s property market remains high, with the UK, specifically London, also having the most active property market in Europe during the first quarter of 2017.

The reasons for this confidence are multiple; stability, capital appreciation, an internationally favourable time zone, a stable rule of law and the global English language. The UK also holds a particular appeal for overseas parents wishing to give their children the very best education, alongside the potential benefits of capital growth when investing in property for the duration of the child’s stay. This asset can then be used to provide rental income thereafter.

The weaker pound has also seen foreign investors getting more for their money, providing additional property investment opportunities for savvy investors.

This survey echoes the findings of the latest Global Cities report which compares the cost of employing 100 staff, and renting the necessary office space, in different countries around the world. London costs 25% less than New York (US$ 6,938,000 per year) and 13% less than Hong Kong (US$ 5,964,990). It’s just another reason why London is fast-becoming known as the world’s capital city.

The UK as a whole is seen as a stable market, moving to fourth position from fifth last year in the votes for which country offered the most stable and secure real estate investment opportunities.

It’s a view that is shared by our investor clients with us during our frequent Director trips and visits to our international offices. During property seminars and private client meetings, we share the latest on London’s rental market including the upcoming property hotspots and trends, plus changes to UK tax laws and legislation.

If you would like to get regular updates from our property experts and Directors, including our monthly London rental market report, simply click here to sign up.

International offices